| | EDUCATION Master of Business Administration,

Santa Clara University Bachelor of Arts, University of

California, Los Angeles Mr. Scilacci has significant leadership and operational management experience through serving as CFO of Edison International, a publicly-traded company whose market cap increased substantially during Mr. Scilacci’s tenure. He has extensive experience communicating with Wall Street analysts, investors and rating agencies and has demonstrated a strong track record of considerable shareholder value creation. He has extensive utility experience through his over 20 years in financial management with Southern California Edison, the primary energy supply company for Southern California. Southern California Edison is a leader in development and implementation of grid modernization, electrification of transportation, renewable energy and energy efficiency. Mr. Scilacci was the CFO of Edison International’s competitive generation subsidiary. During his tenure, Edison International made material investments in wind energy and natural gas-fired generation. He also oversaw the subsidiaries’ energy trading business. Mr. Scilacci has a keen understanding and extensive knowledge of enterprise risk management from his role as Chief Financial Officer of Edison International. For eight years, Mr. Scilacci managed Edison International’s enterprise risk management program identifying, monitoring and forecasting new risks to the company including ESG related risks such as the impacts of climate change. PROFESSIONAL EXPERIENCE Over 30 years of experience, and 25 years in executive leadership, for Edison International companies (including CFO of Edison International, Edison Mission Energy and Southern California Edison) OTHER POSITIONS Director, Chair of the Finance Committee, Member of Audit Committee, Loyola High School of Los Angeles (since 2015) President (2019) and Director (2017-2019), Bel-Air Bay Club Director, American Savings Bank (HEI Subsidiary) (2022-2023) Director, Shipshape Solutions, Inc. (since 2023)

Director Nominees for Election

| | | | |

Scott W.H. Seu | | | | President and CEO, HEI Executive Committee Member | |

| | Age: 58 HEI Director Since: 2022 Principal Occupation: President and Chief Executive Officer, HEI (since 2022) | |

| | EXPERTISE | | | | | | | CLEAN ENERGY, UTILITIES | | | | | | | LEADERSHIP | | | | Eva T. Zlotnicka![[MISSING IMAGE: ico_community-k.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041136/ico_community-k.gif) Independent Director Compensation Committee Member

| | | COMMUNITY RELATIONS | Age: 38

Independent Director Since: 2020

Principal Occupation: Founder,

Managing Partner & President, Inclusive

Capital Partners (2020-present)

| | | | | | GOVERNMENT AND REGULATIONS | | | | Ms. Zlotnicka’s experience as a sustainable investing professional with a background in utilizing markets, policy, and partnership to motivate the private sector to simultaneously improve sustainability, profitability and competitiveness, brings a highly valuable perspective to the Board. In her prior position as Managing Director for the ValueAct Spring Fund she identified companies whose technology and products are solving environmental and social issues and actively supported them through various industry, governance or other significant transitions. Most recently, Ms. Zlotnicka founded Inclusive Capital Partners, a U.S.-based environmental and social impact investment company where she also serves as its Managing Partner and President.![[MISSING IMAGE: ico_corporate-k.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041136/ico_corporate-k.gif) As director at Unifi, where she serves as chair of the nominating and corporate governance committee and as a member of the audit committee, Ms. Zlotnicka has experience in guiding the implementation of ambitious sustainability strategies in addition to other strategic efforts and financial oversight. Recently she was recognized among Women Inc.’s 2019 Most Influential Corporate Board Directors. Prior to founding Inclusive Captial Partners, she was Founder and Managing Director of the ValueAct Spring Fund and Head of Stewardship at ValueAct Capital. Prior to joining ValueAct Capital in 2018, Ms. Zlotnicka served as the US lead Sustainability and Environmental, Social and Governance (ESG) equity research analyst at Morgan Stanley. During her tenure, Morgan Stanley’s Global Sustainability Research team ranked #1 in Sustainable and Responsible Investment Research by the 2017 Extel IRRI survey. Ms. Zlotnicka was also individually ranked as #1 for “Best Understanding of Companies” as voted by corporate participants. Additionally, Ms. Zlotnicka has familiarity with the academic, public and non-profit sectors, most notably having worked with the US Environmental Protection Agency on public-private partnerships and the Environmental Defense Fund on corporate investment in energy efficiency.

PROFESSIONAL EXPERIENCE

Over ten years of experience in sell-side research in sustainability, ESG and fixed income, including leading sustainability research teams at Morgan Stanley

Managing Director, ValueAct Spring Fund; Head of Stewardship, ValueAct Capital (2018 to 2020)

PUBLIC COMPANY BOARDS

Unifi, Inc. (since 2018) (innovative textile products)

OTHER POSITIONS

Co-Founder, Women Investing for a Sustainable Economy (“WISE”) (since 2012)

Board Observer, Arcadia Power, Inc. (since 2018)

Investor Advisory Group Member, Sustainability Accounting Standards Board (since 2019)

Advisory Board Member, Institute for Corporate Governance and Finance, New York University School of Law (since March 2020)

| | | CORPORATE TRANSFORMATION | | | | EDUCATION

Master of Business Administration and Master

of Environmental Science, Yale University

Bachelor of Science in Economics, Wharton

School, and

Bachelor of Science in Computer

Science & Engineering, University of

Pennsylvania

|

TABLE OF CONTENTS

| | CORPORATE GOVERNANCE![[MISSING IMAGE: ico_finance-k.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041136/ico_finance-k.gif) | | | FINANCE AND ACCOUNTING | |

EDUCATION Bachelor of Science Engineering,

Stanford University Master of Science Engineering,

Stanford University Mr. Seu has extensive utility operational expertise having served in numerous leadership positions at Hawaiian Electric Company for over 28 years. Most recently, he served as president and CEO of Hawaiian Electric. CORPORATE GOVERNANCEMr. Seu is an innovative business leader. As President of Hawaiian Electric, Mr. Seu was responsible for ensuring reliable, safe and affordable provision of electric power to 95% of Hawai‘i’s population. He was instrumental in leading the company to transition to cleaner, renewable energy supporting the state’s goal of 100% renewable energy by 2045 and led the development of the utility’s climate change action plan, including a goal of 70% carbon emissions reduction by 2030 and net zero emissions (or better) by 2045.Mr. Seu has extensive business, regulatory and community leadership experience through serving as senior vice president of public affairs at Hawaiian Electric. He has also been actively engaged in critical infrastructure resilience issues in Hawai‘i and at the national level. Prior to joining Hawaiian Electric, Mr. Seu worked as a mechanical and environmental engineer at companies in California and also worked abroad in China. PROFESSIONAL EXPERIENCE President and Chief Executive Officer, Hawaiian Electric Company (February 2020 — December 2021) Senior Vice President, Public Affairs, Hawaiian Electric Company (January 2017 — February 2020) Vice President, System Operation, Hawaiian Electric Company (May 2014 — December 2016) Vice President, Energy Resources and Operations, Hawaiian Electric Company (January 2013 — April 2014) Vice President, Energy Resources, Hawaiian Electric Company (August 2010 — December 2012) OTHER POSITIONS Director, Queen’s Health Systems (since 2023) Director, Edison Electric Institute (the primary electric utility industry association representing all U.S. investor-owned electric companies) (since 2022) Director, Partners in Development Foundation (Hawai‘i non-profit serving families in need) (since 2022) Director, Regional Advisory Board Teach for America Hawai‘i (since 2017) Director, Electric Power Research Institute (EPRI) (since 2020) Chair (since 2017), Director (since 2008), Hale Kipa (a leading Hawai‘i non-profit providing safety net services to at-risk youth for over 50 years) Director, American Savings Bank (HEI subsidiary) since 2022 (Chair 2022-2023)

Corporate Governance HEI’s governance policies and guidelines

HEI’s Board and management review and monitor corporate governance trends and best practices on an ongoing basis, including for purposes of making necessary and advisable updates to HEI’s corporate governance documents and complying with the corporate governance requirements of the New York Stock Exchange (NYSE), rules and regulations of the U. S. Securities and Exchange Commission (SEC) and rules and regulations of the Board of Governors of the Federal Reserve applicable to HEI as a savings and loan holding company. HEI’s corporate governance documents (such as the charters for the Audit & Risk, Compensation & Human Capital Management, Nominating and Corporate Governance and Executive Committees, Corporate Governance Guidelines and Corporate Code of Conduct, as well as other governance documents) are available on HEI’s website at www.hei.com/govdocs (documents referenced as being available on HEI’s website are not incorporated herein). The Board’s leadership structure

Since May 5, 2020, Admiral Fargo has served as the nonexecutive ChairpersonChair of the Board. Admiral Fargo has served on the Board since 2005, and has never been employed by HEI or any HEI subsidiary. The Board has determined that he is independent under applicable standards for director independence, as discussed below under the heading “Board of Directors—Directors — Independent Directors”.Directors.” Among the many skills and qualifications that Admiral Fargo brings to the Board, the Board considered: (i) his extensive experience in corporate governance from serving on a number of other public company, private company and nonprofit boards; (ii) his track record of effective consensus and relationship building and business and community leadership, including serving as Commander of the U.S. Pacific Command; (iii) his willingness to spend time advising and mentoring members of HEI’s senior management; and (iv) his dedication to committing the hard work and time necessary to successfully lead the Board. The responsibilities of HEI’s ChairpersonChair are to: •

lead Board and shareholder meetings and executive sessions of the independent directors, including executive sessions at which the performance of the CEO is evaluated by the Board; •

attend meetings of the Board’s committees, either as member or observer; •

work closely with the Nominating and Corporate Governance Committee into periodically evaluatingevaluate board and committee structures, as well as advise with respect to succession planning for the Board; •

serve on and/or advise the boards of HEI’s primary operating subsidiaries, Hawaiian Electric and ASB, chair joint executive sessions of the independent directors of HEI and these subsidiary boards and attend meetings of subsidiary board committees; •

be available to other Board and subsidiary board members and management for questions and consultation; and •

ensure and facilitate communications among Board members and Board committees and between the Board and management. The Board’s Corporate Governance Guidelines provide that if the ChairpersonChair and CEO positions are held by the same person, or if the Board determines that the ChairpersonChair is not independent, the independent directors should designate an independent director to serve as “Lead Director.” If a Lead Director is designated, the Lead Director’s responsibilities are to: (i) preside at Board and shareholder meetings when the ChairpersonChair is not present; (ii) preside at executive sessions of the independent directors; (iii) facilitate communication between the independent directors and the ChairpersonChair or the Board as a whole; (iv) call meetings of the non-management or independent directors in executive session; (v) participate in approving meeting agendas, schedules and materials for the Board; and (vi) perform other functions described in the Corporate Governance Guidelines or as determined by the Board from time to time. The Board believes that its current leadership structure, which provides for an independent nonemployee Chairperson,Chair, or an independent Lead Director if the ChairpersonChair is not independent, is appropriate and effective based on HEI’s current operations, strategic plans and overall corporate governance structure. Several reasons support this conclusion. First, the Board believes that having an independent ChairpersonChair or Lead Director has been important in establishing a “tone at the top” for both the Board and the Company that encourages constructive expression of views that may differ from those of senior management. Second, the Board believes that the presence of an independent ChairpersonChair or Lead Director demonstrates to the Company’s regulators and shareholders that the Board is committed to serving the best interests of the Company and its shareholders and not the best interests of management. Third, the Board recognizes that HEI has an uncommon corporate governance structure in that the boards of its two primary TABLE OF CONTENTS

operating subsidiaries are also composed mostly of nonemployee directors and that the HEI ChairpersonChair plays an important leadership role for the consolidated company. For instance, in addition to chairing executive sessions of the nonemployee directors, the ChairpersonChair leads the HEI Board in its oversight role with respect to HEI’s subsidiaries. The Board’s role in risk oversight

HEI is a holding company that operates principally through its Hawaii-basedHawai‘i-based electric public utility (Utility or Hawaiian Electric) and bank (Bank or ASB) subsidiaries. At the holding company and subsidiary levels, the Company faces a variety of risks, including (without limitation) operational risks, climate and sustainability related risks, including wildfire risk, regulatory (including environmental regulations) and legal compliance risks, credit and interest rate risks, competitive risks, liquidity risks, capital risks, cybersecurity risks, and strategic reputational and sustainability relatedreputational risks among others. Developing and implementing strategies to identify, assess, mitigate, manage and report on the

Company’s key risks is the responsibility of management, and that responsibility is carried out by assignments of responsibility to various officers and other employees of the Company under the direction of HEI’s Chief Financial Officer, who also serves as the HEI Chief Risk Officer. The role of the Board is to oversee the management of these risks. The Board’s specific risk oversight functions are as follows: •

The Board has approved a consolidated enterprise risk management (ERM) system recommended by management. The system is designed to identify and assess risks across the HEI enterprise so that information regarding the Company’s key risks can be reported to the Board, along with proposed strategies for mitigating and managing these risks. The structure of the ERM system is decentralized, with separate Chief Risk Officers at each of Hawaiian Electric and ASB in addition to HEI’s Chief Risk Officer (HEI CRO). The ERM function for “other” operations of HEI, such as Pacific Current, are performed by the HEI CRO or HEI employees under the supervision of the HEI CRO. Hawaiian Electric’s Chief Financial Officer, who also serves as its Chief Risk Officer, is responsible for identifying, assessing, managing, monitoring and reporting risks at the Utility, and its subsidiaries that operate onwhich serves the neighbor islands of Hawaii,O‘ahu, Hawai‘i, Maui, MolokaiMoloka‘i and Lanai.Lana‘i. ASB’s Executive Vice President — Enterprise Risk & Regulatory Relations serves as its Chief Risk Officer, responsible for establishing ASB’s enterprise risk management program that is approved by the ASB Board Risk Committee. Each subsidiary Chief Risk Officer reports directly to the respective subsidiary President and functionally to the HEI CRO, who reviews such risks on a consolidated basis. In addition, the ASB CRO reports functionally to the ASB Board Risk Committee Chair. The Board believes that this decentralized risk management structure is appropriate and effective for the Company’s diverse operations and holding company structure, because it allows for industry-specific key risk identification and management at the subsidiary levels while also ensuring an integrated and consolidated view of riskkey risks at the holding company level by the HEI CRO. In connection with approving this ERM system, the Board reviewed (and continually assesses) a catalog of key risks and management’s assessment of those risks. As part of the Board’s ongoing risk oversight, the HEI CRO is responsible for providing regular reports to the Board and Audit & Risk Committee on the status of those key risks, any changes to the key risk catalog or management’s assessment of those risks, and any other key risk management matters that the Board may request from time to time. The Board and Audit & Risk Committee also receive reports from HEI’s internal auditor evaluating the effectiveness of management’s implementation of the approved ERM system. •

The Board has assigned to the Audit & Risk Committee the responsibility of assisting in the oversight of the overall risk management strategysystem of the Company. In providing such assistance, the Audit & Risk Committee is specifically required to discuss policies with respect to risk assessment and risk management, including the guidelines and policies governing the process by which risk assessment and risk management are undertaken at the Company, and to report to the Board the committee’s discussion and findings so that the entire Board can consider changes (if any) in the Company’s risk profile. •

The Board has also assigned to the Audit & Risk Committee the specific risk oversight responsibilities of: (i) reviewing the Company’s major financial risk exposures and the steps management has taken to monitor and manage such exposures; (ii) overseeing HEI’s Code of Conduct compliance program; and (iii) establishing procedures for direct reporting of potential accounting and auditing issues to the Audit & Risk Committee. The Audit & Risk Committee reports to the Board each quarter regarding these matters. •

The Board has assigned to the Compensation & Human Capital Management Committee the specific risk oversight responsibility of reviewing whether the compensation policies or practices of HEI or its subsidiaries encourage employees to take risks that are reasonably likely to have a material adverse effect on such entities as well as risks related to human capital management and of recommending new or revised policies and practices to address any such identified risks. Included in this oversight responsibility is the Compensation & Human Capital Management Committee’s review and evaluation of ASB’s compensation practices for compliance with regulatory guidance on sound incentive compensation plans. The Compensation & Human Capital Management Committee reports the results of its review and any recommendations to the Board. The results of the review are also communicated to the Audit & Risk Committee through the HEI CRO.Committee. Both the Audit & Risk and Compensation & Human Capital Management Committees are composed entirely of independent directors.

TABLE OF CONTENTS

In addition to overall risk oversight by the HEI Board, the boards of HEI’s primary operating subsidiaries, Hawaiian Electric and ASB, are responsible for overseeing risks at their respective companies. The Hawaiian Electric Board has assigned responsibility for ongoing oversight of risk management to its Audit & Risk Committee and the ASB Board has assigned such responsibility to its Risk Committee. Under the decentralized ERM structure discussed above, risk management activities at the subsidiary level are reported to the respective subsidiary committee and subsidiary board through the applicable subsidiary Chief Risk Officer. The HEI Board and/or Audit & Risk Committee may also be invited to participate in risk oversight discussions by these subsidiary boards and/or committees. The information from these subsidiary board and committee sessions are reported, on at least a quarterly basis, to the HEI Board by the applicable subsidiary Chief Risk OfficersOfficer (or theirhis/her representatives), who functionally report to the HEI CRO (and, for the ASB Chief Risk Officer, also to the ASB Board Risk Committee Chair) on risk management matters. These subsidiary boards are composed primarily of nonemployee directors. The subsidiary audit committees also are composed primarily of nonemployee directors who meet the independence requirements for audit committee members of companies listed on the NYSE, and with regard to the ASB Audit Committee, comply with FDIC regulations. •

At least annually, the Board conducts a strategic planning and risk review. As part of this review, the Board reviews fundamental financial and business strategies and assesses the majorkey and emerging risks facing the Company, including sustainability-related risks, and available alternatives to mitigate those risks. To facilitate strategic planning through constructive dialogue among management and Board members, members of management who are not directors are invited to participate in the review. Based on the review, the Board and senior management, including the HEI CRO, identify key issues to be addressed during the course of the next calendar year. The Board believes that, for risk oversight, it is especially important to have an independent ChairpersonChair or Lead Director in order to ensure that differing views from those of management are expressed. Since the HEI ChairpersonChair attends the meetings of the Board, the subsidiary boards and their respective committees, the HEI ChairpersonChair is also in a unique position to assist with communications regarding risk oversight and risk management among the Board and its committees, between the subsidiary boards and their respective committees and between directors and management.

Selection of nominees for the Board

The Board believes that there are skill sets, qualities and attributes that should be represented on the Board as a whole, but do not necessarily need to be possessed by each director. The Nominating and Corporate Governance Committee and the Board, thus, consider the qualifications and attributes of incumbent directors and director candidates both individually and in the aggregate in light of the current and future needs of HEI and its subsidiaries. The Nominating and Corporate Governance Committee assists the Board in identifying and evaluating persons for nomination or re-nomination for Board service or to fill a vacancy on the Board. To identify qualified candidates for Board membership, the Committee may consider persons who are serving on its subsidiary boards as well as persons suggested by Board members, management and shareholders, or may retain a third-party search firm to help identify qualified candidates. The Committee’s evaluation process does not vary based on whether a candidate is recommended by a shareholder, a Board member, a member of management or through self-nomination. Once a person is identified as a potential director candidate, the committee may review publicly-available information to assess whether the candidate should be further considered. If so, a committee member or designated representative for the committee will contact the person. If the person is willing to be considered for nomination, the person is asked to provide additional information regarding his or her background, his or her specific skills, experience and qualifications for Board service, and any direct or indirect relationships with the Company. In addition, one or more interviews may be conducted with committee and Board members, and committee members may contact one or more references provided by the candidate or others who would have firsthand knowledge of the candidate’s qualifications and attributes. In evaluating the qualifications and attributes of each potential candidate (including incumbent directors) for nomination or re-nomination or appointment to fill a vacancy, the committee considers: •

the candidate’s qualifications, consisting of his/her knowledge (including relevant industry knowledge), understanding of the Company’s businesses and the environment within which the Company operates, experience, skills, substantive areas of expertise, financial literacy, innovative thinking, business judgment, achievements and other factors required to be considered under applicable laws, rules or regulations; •

the candidate’s attributes, comprisingwith an emphasis on independence, diversity, personal and professional integrity, character, reputation, ability to represent the interests of all shareholders, time availability in light of other commitments, dedication, absence of conflicts of interest, diversity, appreciation of multiple cultures, TABLE OF CONTENTS

commitment to deal responsibly with social issues and other stakeholder concerns and other factors that the committee considers appropriate in the context of the needs of the Board; •

familiarity with and respect for corporate governance requirements and practices; •

with respect to incumbent directors, the self-evaluation of the individual director, his or her current qualifications and his or her contributions to the Board; •

the current composition of the Board and its committees; and •

intangible qualities of the candidate including the ability to ask difficult questions and, simultaneously, to work collegially with members of the Board, as well as to work effectively with management. The Board considers the recommendations of the Nominating and Corporate Governance Committee and then makes the final decision whether to re-nominate incumbent directors and whether to approve and extend an invitation to a candidate to join the Board upon appointment or election, subject to any approvals required by law, rule or regulation. Diversity in identifying nominees for the Board

In assisting the Board in identifying qualified director candidates, the Nominating and Corporate Governance Committee considers whether the candidate would contribute to the expertise, skills and professional experience, as well as to the diversity of the Board in terms of race, ethnicity, gender, age, geography and cultural background. The Board believes it functions most effectively with members who collectively possess a range of substantive expertise, skills and experience in areas that are relevant to leading HEI in accordance with the Board’s fiduciary responsibilities. The Board also believes that having a board composed of members who can collectively contribute a range of perspectives, including perspectives that may arise from a person’s race, ethnicity, gender, age, geographic location and cultural background, improves the quality of the Board’s deliberations and decisions because it enables the Board to view issues from a variety of perspectives and, thus, more thoroughly and completely. As the Company’s operations and strategic plans and the Board’s composition may evolve over time, the Nominating and Corporate Governance Committee is charged with identifying and assessing the appropriate mix of knowledge areas, qualifications and personal attributes contributed by Board members that will bring the most strategic and decision-making advantage to HEI. To reflect its commitment to diversity, in connection with the use of a third-party search firm to identify potential director candidates, the Nominating and Corporate Governance Committee will instruct the search firm to include in its initial list of candidates qualified candidates who reflect diverse backgrounds, including diversity of gender and race or ethnicity.With operations exclusively in the State of Hawai‘i, it is important that our Board includes members who currently or in the past have lived and worked in the state and have knowledge of, and experience with, our customer base and the unique cultural, political and regulatory environment. It is also important that Board members understand and reflect the cultural, racial and gender diversity that exists in Hawai‘i. If the shareholders vote to elect the threeseven director nominees proposed by the Board for election at the 20212024 Annual Meeting the resulting composition of the Board would be as follows: eight directors (or 80%) who are Caucasian, one director (or 10%) who is Asian American and one director (or 10%) who is Native Hawaiian and five directors (or 50%) ofshown in the ten directors would be female.table in the Proxy Summary, under the heading “Current Directors”. The Board also recognizes that, due to Hawaii’sHawai‘i’s geographic isolation from the continental United States and the comparatively small number of publicly traded companies, banks and regulated utilities based in Hawaii,Hawai‘i, the Board also benefits from having among its members

directors who have gained business experience at companies located in other states; those Board members contribute valuable information about experiences they have had working at or serving on the boards of other public companies and companies in similar industries, which also contributes to the breadth of perspectives on the Board. Director resignation policies

Through its Corporate Governance Guidelines, the Board requires its members to submit a letter of resignation for consideration by the Board in certain circumstances. A director must tender his or her resignation in the event of a significant change in the director’s principal employment and at the end of the term during which the director reaches the age of 75. In addition to the evaluation process discussed under “Corporate Governance — Selection of nominees for the Board,” requiring a director to submit a letter of resignation in these two circumstances ensures that the Board examines whether a director’s skills, expertise and attributes continue to provide value over time. The Nominating and Governance Committee recommended, and the Board approved, selecting Adm. Fargo as a nominee director at the 2024 Annual Meeting in spite of reaching the age of 75 because of Adm. Fargo’s leadership experience and institutional knowledge to assure governance continuity and stability during a period of extraordinary challenges.A director must also submit his or her resignation for consideration by the Board if the director is elected under the plurality vote standard for contested elections in which the number of nominees or proposed nominees exceeds the number of directorsan uncontested election fails to be elected (described under Article Fifth of the Company’s Amended and Restated Articles of Incorporation), but does not receive the support of the majority of votes cast. In such an event, the Board will evaluate the reasons for the voting result and determine how best to address the shareholder concerns underlying that result. In some cases, the Board may decide that the best approach is to accept the director’s TABLE OF CONTENTS

resignation. In other cases, the Board may discover that a shareholder concern that was the cause of the vote outcome may more appropriately be addressed by taking other action. The Board’s role in management succession planning

The Board, led by its Nominating and Corporate Governance Committee, is actively engaged in succession planning and talent development, with a focus on the CEO and senior management of HEI and its operating subsidiaries. The Board and the Nominating and Corporate Governance Committee consider talent development programs and succession candidates through the lens of Company strategy and anticipated future opportunities and challenges. At its meetings throughout the year, the Nominating and Corporate Governance Committee reviews progress of talent development and succession programs and discusses internal and external succession candidates, including their capabilities, accomplishments, goals and development plans. The full Board also reviews and discusses talent strategy and evaluations of potential succession candidates annually. The Compensation and Human Capital Management Committee also oversees and discusses talent strategy and workforce planning. In addition, potential leaders are given frequent exposure to the Board through formal presentations and informal events. These reviews, presentations and other interactions familiarize the Board with the Company’s talent pool to enable the Board to select successors for the senior executive positions when appropriate. Due to its robust and active succession planning process, the Board was able to appoint internal successor CEOs to ASB in 2021 and to HEI and Hawaiian Electric in 2022.Shareholder communication with the directors

Interested parties, including shareholders, desiring to communicate with the Board, any individual director or the independent directors as a group regarding matters pertaining to the business or operations of HEI may address their correspondence in care of the Corporate Secretary, Hawaiian Electric Industries, Inc., P.O. Box 730, Honolulu, HI 96808-0730. The HEI Corporate Secretary may review, sort and summarize all such correspondence in order to facilitate communications to the Board. In addition, the HEI Corporate Secretary has the authority and discretion to handle any director communication that is an ordinary course of business matter, including routine questions, complaints, comments and related communications that can appropriately be handled by management. Directors may at any time request copies of all correspondence addressed to them. The charter of the Audit & Risk Committee, which is available for review at www.hei.com/govdocs (documents referenced as being available on HEI’s website are not incorporated herein), sets forth procedures for submitting complaints or concerns regarding financial statement disclosures, accounting, internal accounting controls or auditing matters on a confidential, anonymous basis.

TABLE OF CONTENTS Board of Directors Independent directors

Under HEI’s Corporate Governance Guidelines, a majority of Board members must qualify as independent under the listing standards of the NYSE and any additional requirements as determined by the Board from time to time. •

For a director to be considered independent under NYSE listing standards, the Board must determine that the director does not have any direct or indirect material relationship with HEI or its subsidiaries apart from his or her service as a director. The NYSE listing standards also specify circumstances under which a director may not be considered independent, such as when the director has been an employee of the Company within the last three fiscal years, if the director has had certain relationships with the Company’s external or internal auditor within the last three fiscal years or when the Company has made or received payments for goods or services to entities with which the director or an immediate family member of the director has specified affiliations and the aggregate amount of such payments in any year within the last three fiscal years exceeds the greater of $1 million or 2% of such entity’s consolidated gross revenues for the fiscal year. •

The Board has also adopted Categorical Standards for Director Independence (HEI Categorical Standards), which are available for review on HEI’s website at www.hei.com/govdocs (documents referenced as being available on HEI’s website are not incorporated herein). The HEI Categorical Standards specify circumstances under which a director may not be considered independent. In addition to the circumstances that would preclude independence under the NYSE listing standards, the HEI Categorical Standards provide that a director is not independent if HEI and its subsidiaries have made charitable contributions to a nonprofit organization for which the director serves as an executive officer and the aggregate amount of such contributions in any single fiscal year of the nonprofit organization within the last three fiscal years exceeds the greater of $1 million or 2% of such organization’s consolidated gross revenues for the fiscal year. The Nominating and Corporate Governance Committee and the Board considered the relationships described below in assessing the independence of Board members. Based on its consideration of such relationships and the recommendations of the Nominating and Corporate Governance Committee, the Board determined that all of the nonemployee directors of HEI (Messrs. Dahl, Fargo, Kane, Russell,Kāne and Scilacci and Mss. Connors, Fowler, PowellFlores and Zlotnicka)Fowler) are independent. The remaining director, Ms. Lau,Mr. Seu, is an employee director of HEI and, therefore, is not independent.independent under NYSE listing standards. The Board also previously determined that each of Richard J. Dahl, Michael J. Kennedy and Yoko Otani, who served as directors until August 2023, satisfied the independence requirements of the NYSE listing standards. Relationships considered in determining director independence: With respect to Ms. Flores and Mr. Kane,Kāne, the Board considered amounts paid in the last three fiscal years to purchase electricity from HEI subsidiary Hawaiian Electric (the sole public utility providing electricity to the island of O‘ahu) by the entityentities employing Ms. Flores and Mr. Kane.Kāne. None of the amounts paid by the entities for electricity (excluding pass-through charges for fuel, purchased power and Hawai‘i state revenue taxes) exceeded the thresholds in the NYSE listing standards or HEI Categorical Standards that would automatically result in a director not being independent. Because Hawaiian Electric is the sole source of electric power on the island of O‘ahuahu), the rates Hawaiian Electric charges for electricity are fixed by state regulatory authority, and purchasers of electricity from these public utilities have neither a choice as to supplier nor the ability to negotiate rates or other terms,terms. Accordingly, the Board determined that these relationships do not impair the independence of this director.these directors. Also, with respect to Ms. Connors and Mr. Kane,Kāne, the Board considered charitable contributions in the last three fiscal years from HEI and its subsidiaries to the respective nonprofit organizationorganizations where he servesMs. Connors and Mr. Kāne serve as an executive officer. None of the contributions exceeded the threshold in the HEI Categorical Standards that would automatically result in Ms. Connors or Mr. KaneKāne not being independent. In determining that these donations did not impair the independence of Ms. Connors and Mr. Kane,Kāne, the Board also considered the fact that Company policy requires that charitable contributions from HEI or its subsidiaries to entities where an HEI director serves as an executive officer, and where the director has a direct or indirect material interest, and the aggregate amount donated by HEI and its subsidiaries to such organization would exceed $120,000 in any single fiscal year, be preapproved by the Nominating and Corporate Governance Committee. With respect to Messrs. Fargo and Kane the Board considered other director or officer positions held by those directors at entities for which an HEI executive officer serves as a director or trustee and determined that none of these relationships affected the independence of these directors. None of these relationships resulted in a compensation committee interlock or would automatically preclude independence under the NYSE listing standards or HEI Categorical Standards.

TABLE OF CONTENTS

Board meetings in 2020

2023 In 2020,2023, there were eightseven regular meetings and one14 special meetingmeetings of the Board. All incumbent directors who served on the Board in 20202023 attended at least 93%75% (with all such directors attending at least 87%) of the combined total number of meetings of the Board and Board committees on which they served during the year. period that the director served as a director.Executive sessions of the Board

The nonemployee directors meet regularly in executive sessions without management present. In 2020,2023, these sessions were chaired by Mr. Watanabe until May 5, 2020, and thereafter by Admiral Fargo in each case while serving as the ChairpersonChair of the Board and as an independent nonemployee director. The ChairpersonChair may request from time to time that another independent director chair the executive sessions. Board attendance at annual meetings

All of HEI’s incumbent directors who served on the Board in 2020 remotely2023 attended the virtual 20202023 Annual Meeting of Shareholders. HEI encourages all directors to attend each year’s Annual Meeting.

Board evaluations The Board conducts annual evaluations to determine whether it and its committees are functioning effectively. As part of the evaluation process, each member of the Audit & Risk, Compensation & Human Capital Management and Nominating and Corporate Governance Committees annually evaluates the performance of each committee on which he or she serves. Each director upstanding for reelection also evaluates his or her own performance. The nonemployee directors also periodically complete peer evaluations of the other nonemployee directors. The evaluation process is overseen by the Nominating and Corporate Governance Committee, in consultation with the Chairperson.

TABLE OF CONTENTS | | | COMMITTEES OF THE BOARD

|

COMMITTEES OF THE BOARDCommittees of the Board

Committees of the Board Board committee composition and meetings

The Board has four standing committees: Audit & Risk, Compensation & Human Capital Management, Executive and Nominating and Corporate Governance. Members of these committees are appointed annually by the Board, taking into consideration the recommendations of the Nominating and Corporate Governance Committee. The table below shows the current members of each such committee and the number of meetings each committee held in 2020.2023. | | Name | | Audit &

Risk | | Compensation | | Executive | | Nominating

and

Corporate

Governance | | | | Audit & Risk | | Compensation &

Human Capital

Management | | Executive | | Nominating and

Corporate

Governance | | | | Celeste A. Connors | | | | | | | | | | Celeste A. Connors | | | | | | | | | | | | Richard J. Dahl | | | | | | | | | | Thomas B. Fargo | | | | | | | | | | | | Thomas B. Fargo | | | | | | | | | | Elisa K. Flores | | | | | | | | | | | | Peggy Y. Fowler | | | | | | | | | | Peggy Y. Fowler | | | | | | | | | | | | Micah A. Kane | | | | | | | | | | Micah A. Kāne | | | | | | | | | | | | Constance H. Lau¹ | | | | | | | | | | William James Scilacci Jr. | | | | | | | | | | | | Mary G. Powell | | | | | | | | | | Scott W. H. Seu1 | | | | | | | | | | | | Keith P. Russell | | | | | | | | | | Number of meetings in 2023 | | 9 | | 6 | | 6 | | 4 | | | | William James Scilacci, Jr. | | | | | | | | | | | | | Eva T. Zlotnicka | | | | | | | | | | | | | Number of meetings in 2020 | | 9 | | 5 | | 2 | | 8 | | |

= Chair = Chair | | |  = Member = Member |

1

| Ms. Lau is an employee director. All other directors have been determined to be independent. See “Board of Directors - Independent Directors” above. |

1

Mr. Seu is an employee director. All other directors have been determined to be independent. See “Board of Directors — Independent Directors” above. Functions of the Board’s standing committees

The primary functions of HEI’s standing committees are described below. Each committee operates and acts under written charters adopted and approved by the Board and are available for review on HEI’s website at www.hei.com/govdocs.govdocs (documents referenced as being available on HEI’s website are not incorporated herein). Each of the Audit & Risk, Compensation & Human Capital Management and Nominating and Corporate Governance Committees may form subcommittees of its members and delegate authority to its subcommittees. Audit & Risk Committee Effective February 11, 2020, the Audit Committee changed its name to the Audit & Risk Committee. The Audit & Risk Committee is responsible for overseeing (i) HEI’s financial reporting processes and internal controls; (ii) the performance of HEI’s internal auditor; (iii) risk assessment and risk management policies set by management; and (iv) the Corporate Code of Conduct compliance program for HEI and its subsidiaries. In addition, this committee is directly responsible for the appointment, compensation and oversight of the independent registered public accounting firm that audits HEI’s consolidated financial statements. As part of its risk management oversight responsibility, the Audit & Risk Committee oversees cybersecurity risk. To support the Audit & Risk Committee with this oversight responsibility, the Audit & Risk Committee formed a non-fiduciary cybersecurity working group comprised of directors from HEI, the Utility and ASB boards to assist the Audit & Risk Committee in monitoring the Company’s cybersecurity program. Among other things, the cybersecurity working group reviews the effectiveness of the Company’s cybersecurity programs and practices and the impact of emerging cybersecurity developments on the Company, and provides reports on its work and findings to the Audit & Risk Committee.

The Audit & Risk Committee operates and acts under a written charter, which was adopted and approved by the Board and is available for review at www.hei.com/govdocs.govdocs (documents referenced as being available on HEI’s website are not incorporated herein). The Audit & Risk Committee also maintains procedures for receiving and reviewing confidential reports of potential accounting and auditing concerns. See “Audit & Risk Committee Report” below for additional information about the Audit & Risk Committee. All Audit & Risk Committee members are independent and qualified to serve on the committee pursuant to NYSE and SEC requirements and the Audit & Risk Committee meets the other applicable requirements of the Securities Exchange Act of 1934, as amended (Exchange Act). Messrs. Dahl, RussellMr. Scilacci and ScilacciMs. Flores have been determined by the Board to be “audit committee financial experts”.experts.” Compensation & Human Capital Management Committee The responsibilities of the Compensation & Human Capital Management Committee include: (i) overseeing the compensation plans and programs for employees, executives and nonemployee directors of HEI and its subsidiaries, including equity and incentive plans; (ii) reviewing the extent to which risks that may arise from the Company’s compensation policies and practices, if any, may have a material adverse effect on the Company and recommending changes to address any such risks; (iii) evaluating the compliance of ASB’s incentive compensation practices under the principles for sound incentive compensation plans for banking organizations; and (iv) assessing the independence

of any compensation consultant involved in determining or recommending TABLE OF CONTENTS

COMMITTEES OF THE BOARD

| | | |

director or executive compensation.compensation; and (v) overseeing and monitoring strategies and policies related to human capital management within the workforce, including policies on diversity, equity and inclusion. See “Compensation Discussion and Analysis -— How We Make Compensation Decisions” and “Compensation & Human Capital Management Committee Interlocks and Insider Participation” below for additional information about the Compensation & Human Capital Management Committee. The Compensation & Human Capital Management Committee operates and acts under a written charter, which was adopted and approved by the Board and is available for review at www.hei.com/govdocs.govdocs (documents referenced as being available on HEI’s website are not incorporated herein). All Compensation & Human Capital Management Committee members are independent and qualified to serve on this committee pursuant to NYSE requirements and also qualify as “nonemployee directors” as defined in Rule 16b-3 promulgated under the Exchange Act. An independent member of the board of directors of Hawaiian Electric and ASB attends meetings of the Compensation & Human Capital Management Committee as a nonvoting representative of such director’s subsidiary board. Executive Committee The Executive Committee may exercise the power and authority of the Board when it appears to its members that action is necessary and a meeting of the full Board is impractical. It may also consider other matters concerning HEI that may arise from time to time between Board meetings. The Executive Committee is currently composed of the ChairpersonChair of the Board, who chairs the Executive Committee, the Audit & Risk Committee Chair, the Nominating and Corporate Governance Committee Chair, the Compensation Committee Chair, ASB Risk& Human Capital Management Committee Chair and the HEI President and CEO. The Executive Committee operates and acts under a written charter, which was adopted and approved by the Board and is available for review at www.hei.com/govdocs.govdocs (documents referenced as being available on HEI’s website are not incorporated herein). An independent member of the board of directors of Hawaiian Electric and ASB attends meetings of the Executive Committee as a nonvoting representative of such director’s subsidiary board of directors. Nominating and Corporate Governance Committee The functions of the Nominating and Corporate Governance Committee include: (i) evaluating the background and qualifications of potential nominees for the Board and for the boards of HEI’s subsidiaries; (ii) recommending to the Board the director nominees to be submitted to shareholders for election at the next Annual Meeting; (iii) assessing the independence of directors and nominees; (iv) recommending the slate of executive officers to be appointed by the Board and subsidiary boards; (v) advising the Board with respect to matters of Board and committee composition and procedures; (vi) overseeing the annual evaluation of the Board, its committees and director nominees; (vii) overseeing human capital management, including talent development and succession planning for senior executive positions; (viii) ensuring all Environmental, Social and Governance (ESG) risks and opportunities have appropriate Board oversight, and (ix) making recommendations to the Board and the boards of HEI’s subsidiaries regarding corporate governance and board succession planning matters. The Nominating and Corporate Governance Committee operates and acts under a written charter, which was adopted and approved by the Board and is available for review at www.hei.com/govdocs.govdocs (documents referenced as being available on HEI’s website are not incorporated herein). See “Corporate Governance” above for additional information regarding the activities of the Nominating and Corporate Governance Committee. An independent member of the board of directors of Hawaiian Electric attends meetings of the Nominating and Corporate Governance Committee as a nonvoting representative of such director’s subsidiary board of directors.

TABLE OF CONTENTS DIRECTOR COMPENSATIONDIRECTOR COMPENSATION

DIRECTOR COMPENSATION How director compensation is determined

The Board believes that a competitive compensation package is necessary to attract and retain individuals with the experience, skills and qualifications needed to serve as a director of a publicly traded company operating in a unique blend of highly regulated industries. Nonemployee director compensation is composed of a mix of cash and shares of HEI’s common stock (HEI Common Stock) to align the interests of directors with those of HEI shareholders. Only nonemployee directors are compensated for their service as directors. Ms. Lau,Mr. Seu, the only current employee director of HEI, does not receive separate or additional compensation for serving as a director. Although Ms. LauMr. Seu is a member of the Board, neither shehe nor any other executive officer participates in the determination of nonemployee director compensation. The Compensation & Human Capital Management Committee reviews nonemployee director compensation at least once every three years and recommends changes to the Board. In 2018,2022, the Compensation & Human Capital Management Committee asked its independent compensation consultant, Frederic W. Cook & Co., Inc. (FW Cook), to conduct an evaluation of HEI’s nonemployee director compensation practices. FW Cook assessed the structure of HEI’s nonemployee director compensation program and its value compared to competitive market practices of utility peer companies, similar to the assessments used in its executive compensation review. The 20182022 analysis took into consideration the duties and scope of responsibilities of directors. The Compensation & Human Capital Management Committee reviewed the analysis in determining its recommendations concerning the appropriate nonemployee director compensation, including cash retainers, stock awards and meeting fees for HEI directors. Based on the 20182022 analysis, the Compensation & Human Capital Management Committee recommended, and the Board approved, certain changes to directormaintaining the same compensation for 2019.2023 for HEI’s Non-Employee Directors. The Compensation Committee did not recommend any changes to director compensation for 2020.

Components of director compensation

Cash retainer. HEI nonemployee directors received the cash amounts shown below as a retainer for their 20202023 Board service and for their 20202023 service on HEI and subsidiary board committees. No separate cash fees are paid to HEI directors for service on subsidiary company boards, except to the extent that they serve on any committee of a subsidiary board. Cash retainers were paid in quarterly installments.

| | | | | | | | | HEI Nonexecutive ChairpersonChair of the Board (until May 5, 2020) | | | $250,000

| | 125,000 | | | | | HEI Nonexecutive Chairperson of the Board (effective May 5, 2020) Director | | | 125,000

| | 85,000 | | | | | HEI Director

| | | 75,000

| | | HEI Audit & Risk Committee Chair | | | 20,000

| | 25,000 | | | | | HEI Compensation & Human Capital Management Committee Chair | | | 20,000

| | 25,000 | | | | | HEI Nominating and Corporate Governance Committee Chair | | | 20,000

| | 25,000 | | | | | HEI Audit & Risk Committee Member | | | | | 10,000 | | | | | HEI Compensation & Human Capital Management Committee Member | | | | | 10,000 | | | | | HEI Nominating and Corporate Governance Committee Member | | | | | 10,000 | | | | | Hawaiian Electric Audit & Risk CommitteeASB Nonexecutive Chair

of the Board | | | 15,000

| | 45,000 | | | | | Hawaiian Electric Audit & Risk Committee Member

ASB Director | | | 7,500

| | 85,000 | | | | | ASB Audit Committee Chair | | | 15,000

| | 18,750 | | | | | ASB Audit Committee Member | | | | | 7,500 | | | | | ASB Risk Committee Chair | | | 20,000

| | 25,000 | | | | | ASB Risk Committee Member | | | 10,000

| |

*

| No additional retainer is paid for service on the HEI Executive Committee. |

TABLE OF CONTENTS

DIRECTOR COMPENSATION

10,000 | | | |

*

No additional retainer is paid for service on the HEI Executive Committee. Extra meeting fees. Nonemployee directors are also entitled to meeting fees for each board or committee meeting (other than the Executive Committee) attended (as member or chair) after the number of meetings specified below.

| HEI Board | | | $1,500 per meeting after 8 meetings | | | HEI Audit & Risk Committee | | | $1,500 per meeting after 10 meetings | | | HEI Compensation & Human Capital Management Committee | | | $1,500 per meeting after 6 meetings | | | HEI Nominating and Corporate Governance Committee | | | $1,500 per meeting after 6 meetings | | Hawaiian Electric Audit & Risk Committee

| ASB Board | | | $1,000 per meeting after 8 meetings | | | | ASB Audit Committee | | | $1,000 per meeting after 10 meetings | | | | ASB Risk Committee | | | $1,000 per meeting after 6 meetings | ASB Audit Committee

| | | $1,000 per meeting after 10 meetings

| ASB Risk Committee

| | | $1,000 per meeting after 6 meetings

|

Stock awards. On June 30, 2020,2023, each HEI nonemployee director at that time received shares of HEI Common Stock with a value equal to $100,000$120,000 as an annual grant under HEI’s 2011 Nonemployee Director Stock Plan (2011 Director Plan), which was approved by HEI shareholders on May 10, 2011 for the purpose of further aligning directors’ and shareholders’ interests. The number of shares issued to each HEI nonemployee director was determined based on the closing sales price of HEI Common Stock on the NYSE on June 30, 2020. Stock2023. Customarily, stock grants to nonemployee directors under the 2011 Director Plan are made annually on the last business day in June and vest immediately. HEI considers the 2011 Director Plan to be an important vehicle for the appropriate compensation of its nonemployee directors. Maximum compensation. At its October 29, 2018 meeting, the Compensation Committee recommended, and the Board approved, Nonemployee directors are subject to a maximum annual compensation limit of $600,000, for any nonemployee director, which includes the aggregate grant date fair value of all awards granted to any nonemployee director during any single calendar year plus the aggregate amount of all cash earned and paid or payable to such director for services rendered for the same year. Retirement benefit. HEI’s Nonemployee Director Retirement Plan, which provides retirement benefits to nonemployee directors, was terminated in 1996. Directors who were retired from their primary occupation at that time remained eligible to receive benefits under the plan based on years of service as a director at the time of the plan’s termination. All benefits payable under the plan cease upon the death of the nonemployee director.

Deferred compensation. Nonemployee directors may participate in the HEI Deferred Compensation Plan implemented in 2011 (2011 Deferred Compensation Plan) and described under “Compensation Discussion and Analysis — Benefits — Deferred Compensation Plans” below. Under the plan, deferred amounts are credited with gains/losses of deemed investments chosen by the participant from a list of publicly traded mutual funds and other investment offerings. Earnings are not above-market or preferential. Participants may elect the timing upon which distributions are to begin following separation from service (including retirement) and may choose to receive such distributions in a lump sum or in installments over a period of up to 15 years. Lump sum benefits are payable in the event of disability or death. No nonemployee director participated in this plan in 2020.2023. Nonemployee directors are also eligible to participate in the prior HEI Nonemployee Directors’ Deferred Compensation Plan, as amended January 1, 2009, although no nonemployee director deferred compensation under such plan in 2020.2023. Health benefits. Nonemployee directors may participate, at their election and at their cost, in the group employee medical, vision and dental plans generally made available to HEI, Hawaiian Electric or ASB employees. No nonemployee director participated in such plans in 2020. 2023.TABLE OF CONTENTS

20202023 DIRECTOR COMPENSATION TABLE

The table below shows the compensation paid to HEI nonemployee directors for 2020.2023. | | | | | Fees Earned

or Paid in Cash

($)1 | | | | | | Changes in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings

($) | | | | | | | | | | Celeste A. Connors | | | | | 116,587 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 236,587 | | | | | Richard J. Dahl3 | | | | | 143,451 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 263,451 | | | | | Thomas B. Fargo, HEI Chair4 | | | | | 249,500 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 369,500 | | | | | Elisia K. Flores | | | | | 130,090 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 250,090 | | | | | Peggy Y. Fowler | | | | | 144,880 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 264,880 | | | | | Micah A. Kāne | | | | | 117,000 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 237,000 | | | | | Michael J. Kennedy3 | | | | | 131,927 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 251,927 | | | | | Yoko Otani3 | | | | | 133,929 | | | | | | 160,767 | | | | | | — | | | | | | — | | | | | | 294,696 | | | | | Keith P. Russell5 | | | | | 44,135 | | | | | | — | | | | | | — | | | | | | — | | | | | | 44,135 | | | | | William James Scilacci, Jr. | | | | | 134,500 | | | | | | 120,000 | | | | | | — | | | | | | — | | | | | | 254,500 | | |

1

Represents cash retainers for Board and committee service (as detailed below). 2

For all HEI nonemployee directors, except Ms. Otani, this amount represents an HEI stock award in the value of $120,000, as described above under “Stock Awards”. For Ms. Otani, this amount represents the annual stock award valued at $120,000, plus a new director stock award prorated for the period January 1 — May 5, 2023, in the amount of $40,767. 3

As of August 22, 2023, Richard Dahl, Michael Kennedy and Yoko Otani began serving exclusively on the Board of Directors of ASB. 4

Includes fees Adm. Fargo earned as Chair of the Board. Adm. Fargo’s responsibilities as HEI Chair are described above under “Corporate Governance — The Board’s leadership structure.” 5

Mr. Russell retired from the Board effective May 5, 2023.

| | Celeste A. Connors | | | 86,500 | | | 100,000 | | | — | | | — | | | 186,500 | | | | Richard J. Dahl | | | 103,066 | | | 100,000 | | | — | | | — | | | 203,066 | | | | Thomas B. Fargo, HEI Chairperson3 | | | 185,008 | | | 100,000 | | | — | | | — | | | 285,008 | | | | Peggy Y. Fowler | | | 109,500 | | | 100,000 | | | — | | | — | | | 209,500 | | | | Micah A. Kane | | | 89,500 | | | 100,000 | | | — | | | — | | | 189,500 | | | | Mary G. Powell | | | 86,500 | | | 100,000 | | | — | | | — | | | 186,500 | | | | Keith P. Russell | | | 118,000 | | | 100,000 | | | — | | | — | | | 218,000 | | | | William James Scilacci, Jr. | | | 96,500 | | | 100,000 | | | — | | | — | | | 196,500 | | | | Jeffrey N. Watanabe, Chairperson4 | | | 112,500 | | | — | | | — | | | — | | | 112,500 | | | | Eva T. Zlotnicka | | | 75,192 | | | 122,740 | | | — | | | — | | | 197,932 | |

1

| Represents cash retainers for Board and committee service (as detailed below). |

2

| For all HEI nonemployee directors other than Ms. Zlotnicka, this amount represents an HEI stock award in the value of $100,000, as described above under “Stock Awards.” Due to Ms. Zlotnicka’s appointment on February 12, 2020, she also received a new director stock grant pro-rated to cover the period from the date of her appointment to the 2020 annual meeting. |

3

| Includes fees Adm. Fargo earned as Chairperson of the Board beginning on May 5, 2020. Adm. Fargo’s responsibilities as HEI Charperson are described above under “Corporate Governance —The Board’s leadership structure.” |

4

| Mr. Watanabe’s fees were for service as director and Chairperson of the Board from January 1 - May 5, 2020. He also served on the HEI Executive Committee during the timeframe noted. Mr. Watanabe’s responsibilities as HEI Chairperson are described above under “Corporate Governance — The Board’s leadership structure.” |

The table below shows the detail of cash retainersfees paid to HEI nonemployee directors for Board and committee service (including subsidiary committee service) and for serving on the Cybersecurity Working Group in 2020.2023. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Cyber

Security

Working

Group

($) | | | | | | | Celeste A. Connors | | | | | 85,000 | | | | | | 13,587 | | | | | | — | | | | | | 18,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 116,587 | | | | | Richard J. Dahl2 | | | | | 54,511 | | | | | | 22,446 | | | | | | — | | | | | | — | | | | | | 30,489 | | | | | | 9,864 | | | | | | 16,141 | | | | | | 10,000 | | | | | | — | | | | | | 143,451 | | | | | Thomas B. Fargo, HEI Chair3 | | | | | 85,000 | | | | | | 20,000 | | | | | | 125,000 | | | | | | 19,500 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 249,500 | | | | | Elisia K. Flores | | | | | 85,000 | | | | | | 13,587 | | | | | | — | | | | | | 16,500 | | | | | | — | | | | | | 15,003 | | | | | | — | | | | | | — | | | | | | — | | | | | | 130,090 | | | | | Peggy Y. Fowler | | | | | 85,000 | | | | | | 40,380 | | | | | | — | | | | | | 19,500 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 144,880 | | | | | Micah A. Kāne | | | | | 85,000 | | | | | | 20,000 | | | | | | — | | | | | | 12,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 117,000 | | | | | Michael J. Kennedy2 | | | | | 54,511 | | | | | | 4,392 | | | | | | — | | | | | | — | | | | | | 30,489 | | | | | | 21,535 | | | | | | — | | | | | | 16,000 | | | | | | 5,000 | | | | | | 131,927 | | | | | Yoko Otani2 | | | | | 54,511 | | | | | | 6,413 | | | | | | — | | | | | | — | | | | | | 30,489 | | | | | | 26,516 | | | | | | — | | | | | | 16,000 | | | | | | — | | | | | | 133,929 | | | | | Keith P. Russell4 | | | | | 29,423 | | | | | | 3,462 | | | | | | — | | | | | | — | | | | | | — | | | | | | 11,250 | | | | | | — | | | | | | — | | | | | | — | | | | | | 44,135 | | | | | William James Scilacci, Jr. | | | | | 85,000 | | | | | | 25,000 | | | | | | — | | | | | | 19,500 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 5,000 | | | | | | 134,500 | | |

1

| | Celeste A. Connors | | | 75,000 | | | 10,000 | | | — | | | 1,500 | | | — | | | — | | | | | | 86,500 | | | | Richard J. Dahl | | | 75,000 | | | 26,566 | | | — | | | 1,500 | | | — | | | — | | | | | | 103,066 | | | | Thomas B. Fargo, HEI Chairperson2 | | | 75,000 | | | 23,434 | | | 82,074 | | | 4,500 | | | — | | | — | | | | | | 185,008 | | | | Peggy Y. Fowler | | | 75,000 | | | 30,000 | | | — | | | 4,500 | | | — | | | — | | | | | | 109,500 | | | | Micah A. Kane | | | 75,000 | | | 10,000 | | | — | | | 4,500 | | | — | | | — | | | | | | 89,500 | | | | Mary G. Powell | | | 75,000 | | | 10,000 | | | — | | | 1,500 | | | — | | | — | | | | | | 86,500 | | | | Keith P. Russell | | | 75,000 | | | 10,000 | | | — | | | 1,500 | | | 7,500 | | | 20,000 | | | 4,000 | | | 118,000 | | | | William James Scilacci, Jr. | | | 75,000 | | | 20,000 | | | — | | | 1,500 | | | — | | | — | | | | | | 96,500 | | | | Jeffrey N. Watanabe3 | | | 25,962 | | | — | | | 86,538 | | | — | | | — | | | — | | | | | | 112,500 | | | | Eva T. Zlotnicka | | | 66,346 | | | 8,846 | | | — | | | — | | | — | | | — | | | | | | 75,192 | |

1

| Represents extra meeting fees earned for attending Board and committee meetings in excess of the number of meetings specified in “Director Compensation — Components of director compensation — Extra meeting fees.” |

2

| Adm. Fargo’s fees include fees earned as Chairperson beginning on May 5, 2020. |

3

| Mr. Watanabe’s fees include fees earned as Chairperson of the Board from January 1, 2020 - May 5, 2020. |

TABLE OF CONTENTS

As of August 22, 2023, Richard Dahl, Michael Kennedy and Yoko Otani began serving exclusively on the Board of Directors of ASB. 3

Adm. Fargo’s fees include fees earned as Chair. 4

Mr. Russell retired from the Board effective May 5, 2023. Director stock ownership and retention HEI directors are required to own and retain HEI Common Stock throughout their service with the Company. Each director has until his or her compliance date (January 1 of the year following the fifth anniversary of the later of (i) amendment to his or her required level of stock ownership, or (ii) first becoming subject to the requirements), to reach the following ownership levels: Chairperson of the Board — the number of sharesown that are equal in value to two times the Chairperson’s annual cash retainer

Other HEI directors — the number of shares that are equal in value to five times the director’s annual cash retainer

As of January 1, 2021, each director who had reached his or her compliance date had achieved his or her stock ownership target.retainer. Until reaching the applicable stock ownership target, directors must retain all shares received under their annual stock retainer.

The Compensation & Human Capital Management Committee has the authority to approve hardship exceptions todeviations from these retention requirements.

TABLE OF CONTENTS | | | PROPOSAL NO. 2: ADVISORY VOTE TO APPROVE THE COMPENSATION OF HEI’S NAMED EXECUTIVE OFFICERS

|

PROPOSAL NO.Proposal No. 2: ADVISORY VOTE TO APPROVE THE COMPENSATION OFAdvisory Vote to Approve the Compensation of HEI’S NAMED EXECUTIVE OFFICERSNamed Executive Officers

Proposal No. 2: Advisory Vote to Approve the

Compensation of HEI’S Named Executive Officers We are asking for your advisory vote on the compensation of our named executive officers as described in this Proxy Statement. This proposal, which we present to our shareholders on an annual basis andis commonly known as athe “say-on-pay” proposal, gives shareholders the opportunity to express their views on the overall compensation of our named executive officers and the policies and practices described in this Proxy Statement. The Compensation & Human Capital Management Committee and Board believe that HEI’s executive compensation program is effective in achieving our goals of promotingcreating long-term value for shareholders andour stakeholders, including attracting, motivating and retaining the talent necessary to create such value. Accordingly, the Board recommends that you vote FOR the following resolution: Resolved, that the shareholders approve, in a non-binding advisory vote, the compensation of HEI’s named executive officers as disclosed in the Compensation Discussion and Analysis and Executive Compensation Tables sections of the Proxy Statement for the 20212024 Annual Meeting of Shareholders. Please read the Compensation Discussion and Analysis and Executive Compensation Tables portions of this Proxy Statement. These sections describe the Company’s executive compensation policies and practices and the compensation of our named executive officers. While the say-on-pay vote is advisory and is, therefore, nonbinding, the Compensation & Human Capital Management Committee and Board consider the vote results when making future decisions regarding HEI’s executive compensation. | | | ✓ FOR![[MISSING IMAGE: tm2228839d2-ic_tickroundpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041136/tm2228839d2-ic_tickroundpn.jpg) | | | The Board recommends that you vote FOR the advisory resolution approving the compensation of HEI’s Named Executive Officersnamed executive officers as disclosed in this Proxy Statement. | | |

TABLE OF CONTENTS COMPENSATION DISCUSSION AND ANALYSIS

| | | |

COMPENSATION DISCUSSION AND ANALYSISCompensation Discussion and Analysis

Compensation Discussion and Analysis This section describes our executive compensation program and the compensation decisions made for our 20202023 named executive officers. For 2020,2023, we have fivesix named executive officers: our Chief Executive Officer, our current Chief Financial Officer, our former Chief Financial Officer, our General Counsel, and our two other executive officers during 2020, the chief executives at each of Hawaiian Electric (our electric utility subsidiary) and ASB (our bank subsidiary): | | | | | | | | | | | | ConstanceScott W. H. Lau

Seu | | | HEI President & CEO | | | Holding company | | | | Gregory C. Hazelton

Scott T. DeGhetto1 | | | HEI Executive Vice President, and Chief Financial Officer and Treasurer1 | | | Holding company | | | | Kurt K. Murao | | | HEI Executive Vice President, General Counsel, Chief Administrative Officer and Corporate Secretary | | | Holding company | | | | Scott W. H. Seu*

Shelee M. T. Kimura | | | Hawaiian Electric President & CEO | | | Electric utility subsidiary | | | | Richard F. Wacker

Ann C. Teranishi | | | ASB President & CEO | | | Bank subsidiary | | | | Paul K. Ito2 | | | Former HEI Executive Vice President, Chief Financial Officer and Treasurer | | | Holding company | |

*

| Mr. Seu assumed the role of President and CEO of Hawaiian Electric effective February 15, 2020. For more information please see the applicable Forms 8-K filed with the SEC on December 10, 2019 and February 13, 2020. |

1

Mr. DeGhetto was appointed Executive Vice President, CFO and Treasurer of HEI effective October 1, 2023. For more information, see Form 8-K filed with the SEC on September 18, 2023. 2

Mr. Ito was appointed Senior Vice President, CFO and Treasurer of Hawaiian Electric and resigned as Executive Vice President, CFO and Treasurer of HEI effective as of October 1, 2023. For more information, see Form 8-K filed with the SEC on September 18, 2023. For more information regarding HEI’s executive officers, see the paragraph entitled “Information About Our Executive Officers (HEI)” in Part I of HEI’s annual report on Form 10-K for the fiscal year ending December 31, 20202023 (HEI’s 20202023 Form 10-K), which is incorporated by reference herein. 20202023 Executive summary

Our guiding principles shape our program design and pay decisions In designing HEI’s executive compensation program and making pay decisions, the Compensation & Human Capital Management Committee follows these guiding principles: •

Pay should reflect Company performance, particularly over the long-term;long-term. •

Compensation programs should align executives’ interests with those of our shareholders and other stakeholders; stakeholders. •

Programs should be designed to attract, motivate and retain talented executives who can drive the Company’s success; andsuccess. •

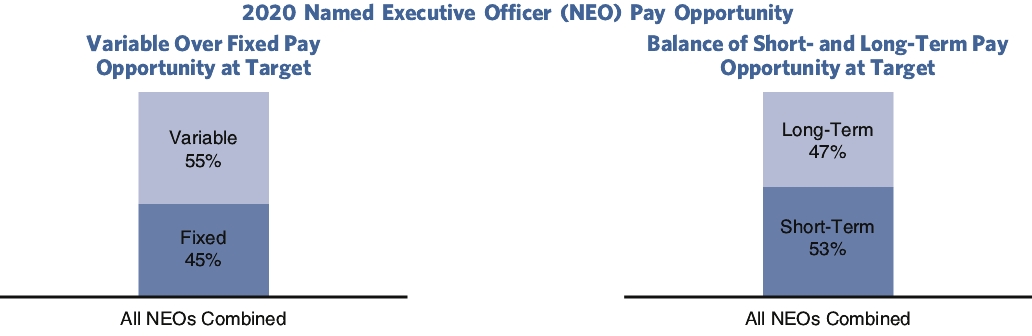

The cost of programs should be reasonable while maintaining their purpose and benefit. Key design features Straightforward design. The compensation program for our named executive officers comprises four primary elements: base salary, performance-based annual incentives, performance-based long-term incentives earned over three years, and time-based restricted stock units (RSUs) that, beginning with grants made in 2021, vest in equal annual installments over fourthree years. Emphasis on performance-based pay. Through the target compensation mix, we emphasize performance-based pay over fixed pay, with the majority of the target compensation opportunity for our named executive officers being linked to the Company’s financial, market and operating results. Balance between short- and long-term components. The compensation program also balances the importance of achieving long-term strategic priorities and critical short-term goals that support long-term objectives.

TABLE OF CONTENTS | | | COMPENSATION DISCUSSION AND ANALYSIS

|

Compensation Discussion and Analysis